On Tuesday, October 13, 2020, in Hotel Europa in Sarajevo, Centre for Policy and Governance (CPU) organized a working meetig of their parliamentary group on the topic of tax reform, or rather the Draft Law on Income Tax of FBiH and the Law on Contributions of FBiH which the FBiH Government sent to the parliamentary procedure.

The working meeting was attended by MPs in the House of Representatives of the FBiH Parliament, Lana Prlić, Nasiha Pozder, Amer Obradović, Dževad Adžem, Nihad Čolpa, analysts Faruk Hadžić, Admir Čavalić, representative of the Association of Freelancers BiH Elena Babić, and CPU representatives. The need to support the process of reducing the taxes on labor in the FBiH was discussed, as well as the ways that can improve the proposals of the FBiH Government. The Government's proposal reduces the cumulative contribution rate from the current 41.5% to 33.5%, and introduces progressive income tax rates of 10% and 20%. The proposal also envisages the expansion of the tax base, in the context of taxation of the fee for hot meals and recourses, while the personal deduction from the taxable portion of the salay is to beincreased from a current minimum of 300 KM to minimum of 700 KM.

The moderator, CPU Executive Director Adis Muhović, presented the Centre's calculation (download HERE) of the planned changes, and based on the key findings of the analysis concluded that although the new drafts fulfill the much-needed reduction in contributions in FBiH, the new laws represent a step in reducing the tax burden in FBiH, or rather, reducing the tax wedge. More precisely, the proposed laws relieve lower salaries, the average salary and salaries up to 1,500 KM. If the "savings" of employers are taken into account, some space is opened up for workers to negotiate salary increases, if they can.

On the other hand, the new proposal negatively affects higher salaries, where expenses on labor become higher for the employers if they want to maintain the same level of income for their workers. The FBiH Government has not yet published an assessment of the macroeconomic effects of the proposed solutions so that citizens and elected representatives in the FBiH Parliament know what effect is expected on income tax and contribution revenues, the estimated growth trend in wages, employment and expenditure, and revenue growth of VAT, based on which they can make an informed decision on supporting such a solution. The government states in its explanation that 55% of workers receive a salary of up to 700 KM, and earlier data suggest that about 23% of workers in FBiH receive a salary of up to 450 KM, while only 12% of workers receive a salary higher than 1500 KM.

Risks that these changes unvail is that employers, in some cases, could simply adjust the salary based on minimal legal requirements, ie. the minimal increase of gross salary envisioned by the changes, which would lead to a significant drop in wages for workers and, at the same time, make savings for the employer. As the Centre stated earlier in its analysis of legal proposals on reducing labor taxation, three scenarios of the implementation of new legal solutions are possible, and at the parliamentary meeting, the adjustment of salaries in accordance with the new legal solutions were discussed as well. All calculations are based on salary grades previously used by the Federal Ministry of Finance, as part of their initial calculation, and examples of the non-taxable part of salaries used by FMF for Akta.ba as one of the examples for salary calculation. Accordingly, the same assumed amount of hot meal (180 KM) was used. Other non-taxable fees, such as transportation or recourse fees, are not taken into account, given that these fees are somewhat less common compared to a hot meal. With a new proposal:

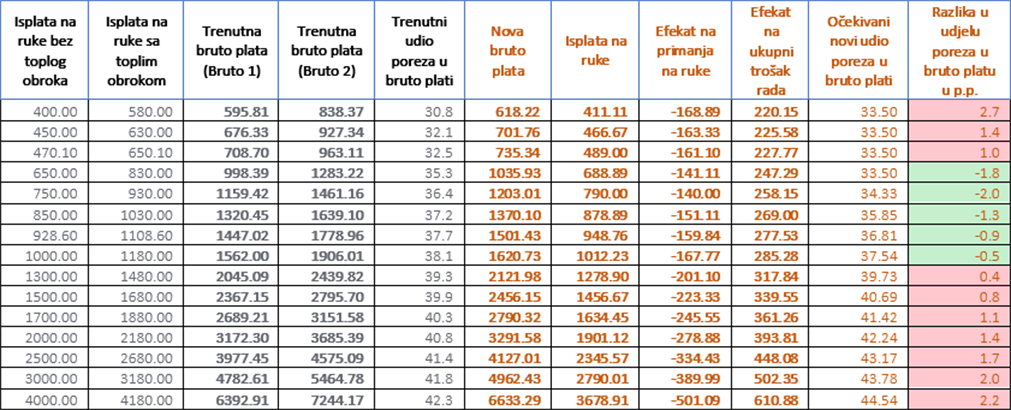

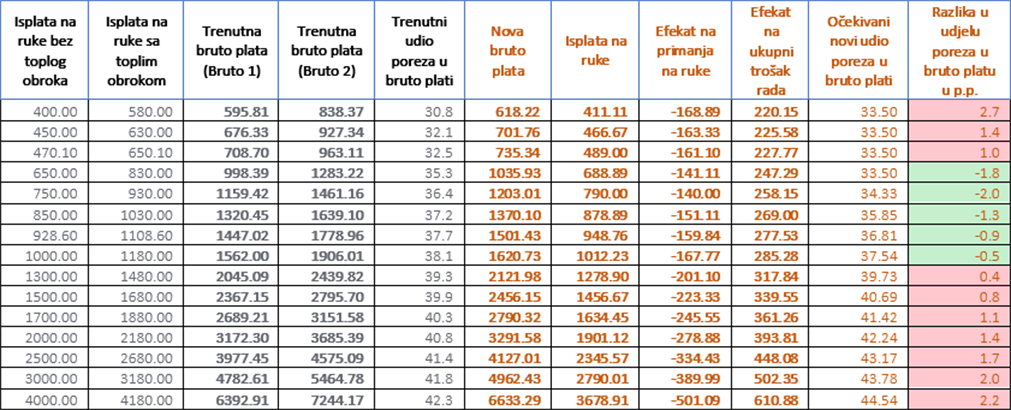

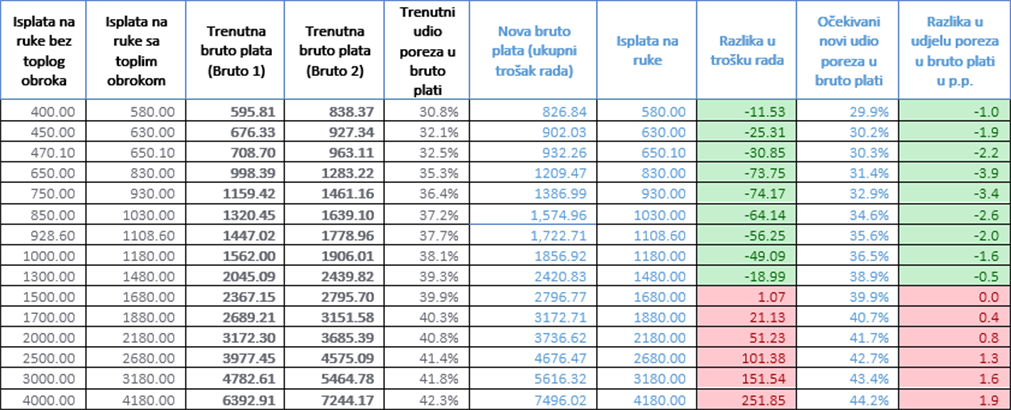

(1) employers can adjust gross wages to minimum new legal obligations, where the effects of current proposals with an extended tax base would look like Table 1;

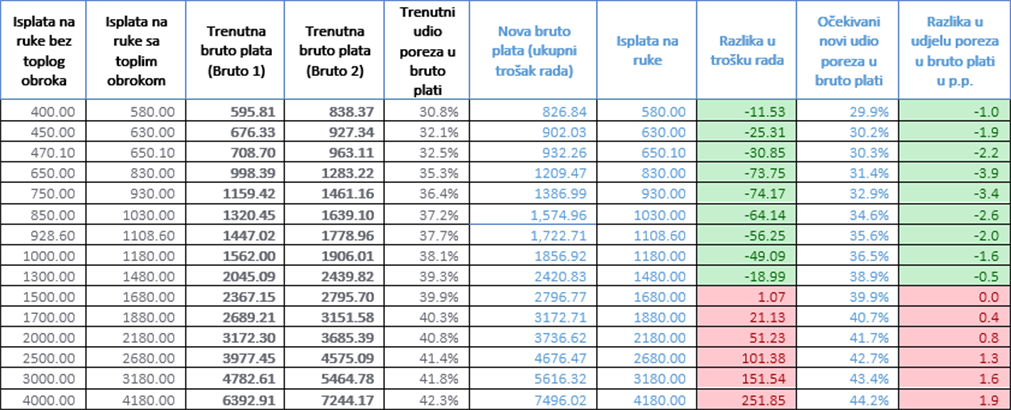

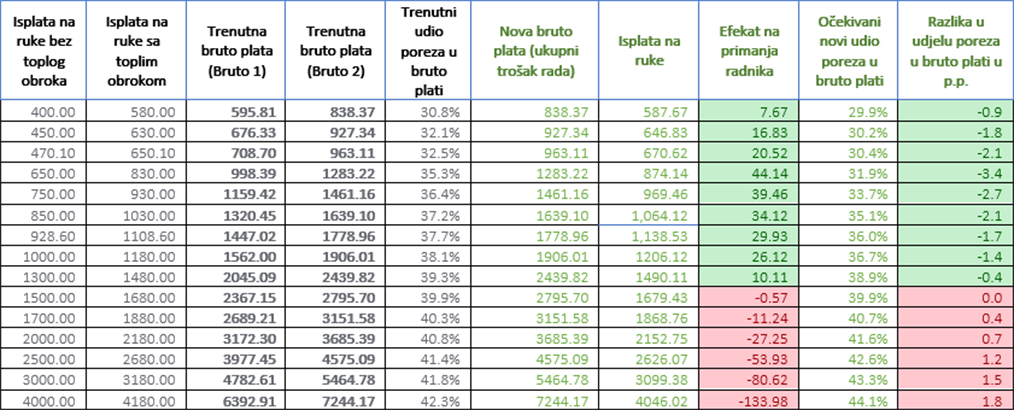

(2) employers leave the same amounts that workers receive "on hand" and gross wages are adjusted in the manner presented in Table 2;

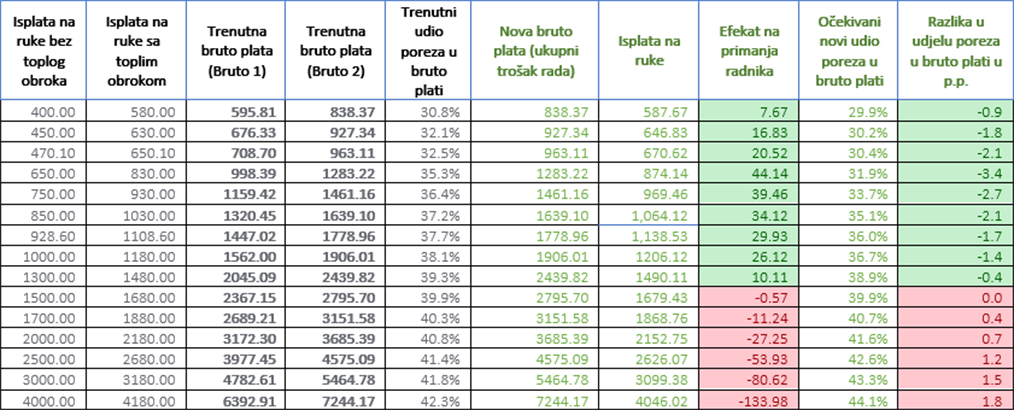

(3) employers do not increase total labor costs, which alter workers' earnings in the manner presented in Table 3.

Table 1: Minimum legal obligation scenario

Table 2: Scenario of the same payment amount with gross salary adjustment (employer costs)

Table 3: Employee benefit adjustment scenario (same employer cost)

Findings

The key conclusions of the meeting will be reflected in amendments to the proposals of the FBiH Government, which will be jointly proposed by the participants of the parliamentary group. The amendments are mianly related to:

- determining the base for the payment of contributions for crafts, which is high in the current proposal of the Government, and disproportionate to the same obligation base for companies, as well as directly related to the average gross salary in the FBiH. In order to encourage the crafts industry, it was proposed that the tax calculation provides tax relief for crafts, which are comparatively more burdened with social contributions compared to companies, and for the calcuation to not be tied to the average salary, which is significantly affected by public sector wages;

- amendments to the proposals in order to avoid taxation of the contract on labor, and service and other types of contracts with the same cumulative contribution rate as the contract on labor, while the amendments to other laws do not regulate the rights that will be enabled by paying this tax obligation.

Centre for Policy and Governance, together with the participants of this parliamentary group, call on the FBiH Government and MPs to consider the proposed amendments in order to improve their proposals and reach a consensus that will reduce the tax burden in the Federation of BiH.